VocaLink has spearheaded a collaborative whitepaper – titled Moving Money 2025 – bringing together the leading voices in the payments industry to predict how payment innovation could change by 2025 and the impact this will have on consumers, businesses, charities and even our interaction with the state.

To accompany the report, 2000 consumers were also polled on their attitudes to current payment methods as well as what they would like to see in the future. The results have clearly demonstrated that, whilst we are a nation that is still getting to grips with a whole host of new ways to pay, the appetite for innovation is accelerating.

Empowering payers to make informed purchases in a way that suits them

83% of consumers surveyed by VocaLink admitted they check their bank balance before making a significant purchase – highlighting that banks have a pivotal role to play in innovating ways for customers to maintain visibility and control of their money. It is likely that in ten years’ time, making informed decisions on expenditure will become even easier since portable communication devices (from smartphones, to watches, glasses, etc.) will help us budget more effectively, providing more options for ring-fencing funds within our bank accounts in seconds and even automatically helping consumers access better ‘deals.’ Over 50% of consumers would be interested in these sorts of apps.

However, flexibility in how we pay is already an acute need for many today. The employment market is changing with a growing number of workers reliant on multiple income flows, rather than having one steady and periodic source of income. One prediction regarding this issue is that by 2025 incomes could become even more erratic so should be met with technology that offers the necessary agility to accommodate these customers.

Similarly, another contributor to the Moving Money whitepaper believes that one of the most successful future innovations will be to make it easier to quickly ‘undo’ payments made in error to the wrong person or organisation. This is a problem nearly 1 in 4 people in the UK, (rising to 1 in 3 for those under 45), have already experienced according to VocaLink’s consumer research. Of these, approximately three quarters eventually got their cash back whilst the rest simply did not see their money again, highlighting the need for a universal process to be devised and adopted in the event of erroneous payments.

Greater security demanded – but flexibility over identity authentication is expected

However we end up paying for things in 2025, security is the number one concern for consumers – 65% identified this as their number one priority when it comes to financial transactions. Contributing experts to the paper agreed, predicting that by 2025 there will be multiple ways of authenticating identity before payment can be made. In fact, as smartphone security increases, physical payment cards are expected to become obsolete since account details will be stored on the device itself. We’ve already seen a glimpse of the impact that biometrics-initiated mobile payments could have in the future and VocaLink’s research has found 1 in 4 UK consumers would consider using biometric technology to access banking or payment services². However, by 2025, some experts believe biometrics will be the principle method to authenticate our identities, with the usage of facial recognition in particular significantly reducing fraud and time/hassle constraints in making payments.

Real-time payments will offer certainty

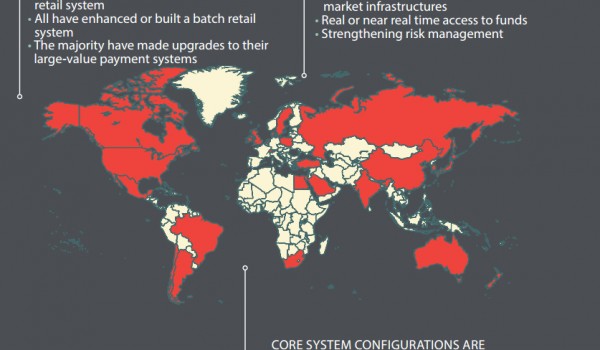

Over the next ten years we will likely see an increase in adoption of immediate payments, via the Faster Payments system, as well as new innovations which build on this existing infrastructure. Larger transactions will become available on an immediate basis, particularly as the value limit on transactions rises past the current level of £100,000. This has obvious benefits for SMEs who will make and receive payment quicker, providing greater cashflow certainty and enhancing growth potential. Paying staff salaries will also be increasingly easy, as a payment can be made at the end of a week to reflect the exact hours worked with the employee receiving their salary immediately.

“The UK is in a fantastic position to make real time payments and all these other predictions a reality over the next decade. We have a world class digital payments infrastructure and this puts us at a distinct advantage – however if we are to stay ahead of the crowd, it is vital we start laying groundwork for the future now,” explains Chris Dunne, Director at VocaLink.

“The collective insight of this whitepaper has shown us what we could and should be able to achieve in the payments sphere. Disparate corners of the UK’s society and economy will benefit hugely if we can map their needs against the evolution of the UK’s payment system and the burgeoning technology that supports it. This collaborative effort is only the beginning; we are keen to catalyse discussion across all relevant parties about what comes next and set the wheels in motion to make future payment technology a reality.”