Global interoperability of real-time payments systems will require harmonisation of market practices and standards. A group of international clearing houses, banks, vendors, payments associations and other parties have proposed setting up an activity to look at how to deliver this under the aegis of the International Standards Organisation – and set an ambitious target of collating an initial variant of ISO 20022 usage guidelines for real-time payments before the summer.

At a meeting organised by the UK Payments Council a very mixed and wide group of 40-plus representatives of global organisations discussed the issues as they see them, agreeing to work together to identify areas where decisions made at this stage of design and implementation could make interoperability easier to achieve – according to an article first published in Banking Technology.

The conclusion of the initial meeting was that no new set of ISO messages needs to be developed, any collaborative activity would be a refinement of the existing messages

“Interoperability between jurisdictions will ultimately be the key to getting value,” said one North American participant, a point that was echoed by another: “Our focus may be domestic but we have an eye on international interoperability.”

Maurice Cleaves, interim chief executive of the Payments Council, said that the intention of the meeting was simply to explore collaboration options: “Collaboration is often the key to success in the development of payment systems, so we are delighted to be facilitating this international dialogue to coordinate around real-time payments. Many countries in the world are still at the early stage of development of a domestic real-time payment system but whilst this is in development it is critical that we have an eye to the future and develop a common standard to enable interoperability. Building this thinking into the requirements at an early stage will ease the adoption by users of systems in multiple countries immediately and smooth the process of interoperability as this becomes a reality.”

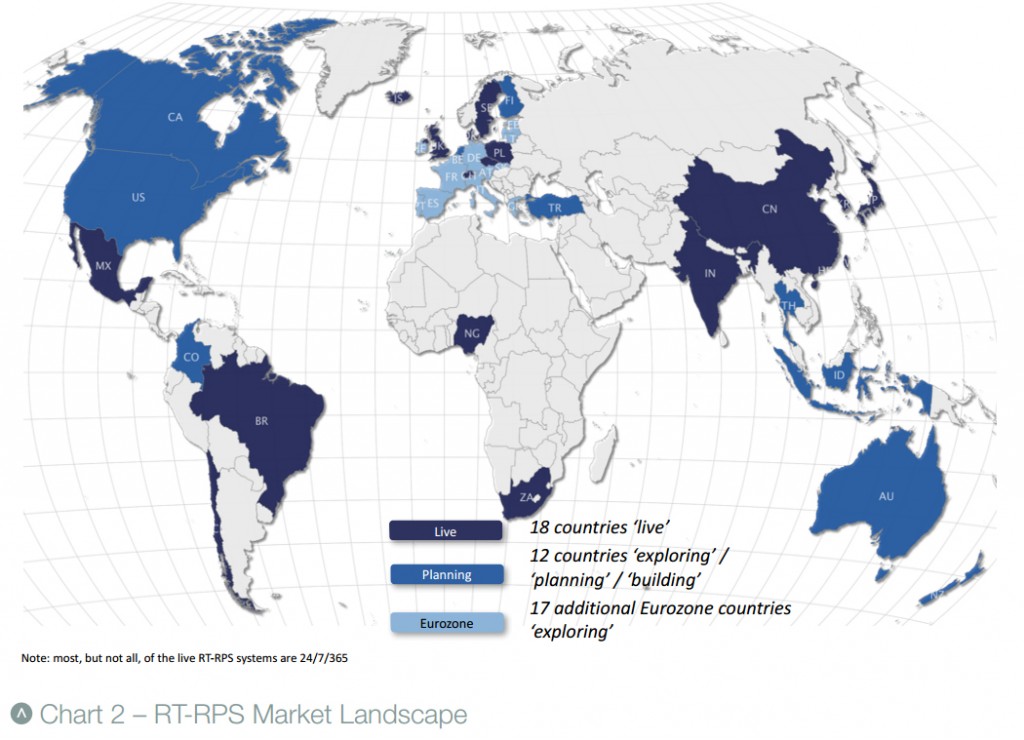

All agreed that the timing is pertinent: many jurisdictions are implementing, or actively thinking about real-time systems. There is a slim window of opportunity to work together “and that time is now”.

Many of those actively implementing are at different stages of development, but are keeping interoperability at the front of their considerations. International compatibility is particularly valuable to multinational banks that have to connect to multiple market infrastructures. The ISO 20022 messaging standard was identified by all as the most appropriate technical standard for real-time payments, and it is unlikely that another would supersede it but there remain issues with implementation, some of which may be due to genuine local requirements.

“Standardisation should seek to standardise what is common and be a platform for innovation and competition, said James Whittle, director of industry dynamics at the Payments Council. “ISO 20022 is not about getting everyone to do the same thing: where there is a need for a difference, we have to understand it and when there isn’t we need to work to harmonise. ISO is not a police force. No-one is going to knock on the door and say you are not implementing it properly. It’s more a question of is what you think is unique to your market really unique? If it is, what’s the fastest way for you to implement it?”

This leads to a follow-up question, as phrased by one delegate: “what is the threshold for uniqueness? Absent an understanding of that we might reach an endpoint that is no better than the status quo.”

One participant said that an 80/20 rule applied and implementers should embrace regional difference and accept that these need to continue for legitimate business reasons. There is a desire to develop a system that is flexible and consistent but will cater for regional differences.

Different jurisdictions have taken different approaches to the way they intend to implement RTP systems. In Australia, and other early movers such as Finland, the approach is based on an overlay concept that means creating a backbone on which different banks can build different products – separating the common parts from what is competitive.

Across jurisdictions the connection method for institutions also varies: in the UK there are 12 direct connections to the Faster Payments Service and smaller institutions have to connect through agency or sponsor arrangement with those organisations – a situation that the incoming Payment Systems Regulator is currently investigating, and operators are seeking to work with vendors to improve. Canada has a similar tiered approach, but the 10,000 US financial institutions are not tiered, making connectivity a considerable issue there.

In settlement there are a number of different approaches: the UK has three daily settlement windows, Finland is proposing two different settlement mechanisms – a real-time high-value and one for low value which would be batch overnight. The US is completely overhauling its National Settlement System which will become a 24/7 platform by the end of this year. Australia has opted for line-by-line real-time settlement.

Not all of the issues are technical: how failed payments or payments made in error are recovered differs across jurisdictions. Agreement will have to be struck on overcoming this: “a request for repayment message is the easy bit – how you use it will require a lot of legal work,” said one.

One area where there is likely to be a large degree of divergence is in the type and amount of data that is carried in a message: for most institutions and corporates the addition of remittance data along with payments data, may be desirable, but it opens a number of issues. One bank participant pointed out that adding both remittance and payment data in one message could add an unacceptable payload to the message, significantly affecting system performance. “We are very reluctant how much payload we can add to the message – we have a limited amount of time in which to processes the messages,” he said.

Adding additional information can place unnecessary strains on the backbone. There is also the question of the type of data: “When Tim Berners-Lee was developing the Internet. He probably wasn’t thinking about cat videos …” observed one participant.

More seriously for institutions, there will likely be anti-money laundering implications in carrying messages without knowing the contents of those messages.

One participant said that real-time payments are largely retail so it is important to look at what data, such as geo-tagging, is being used in that space. “Otherwise we are potentially missing a range of data that will have to be built back in five years’ time.”

All agreed that there was need for wider involvement in the discussions, including credit card schemes and corporate’s. “In ISO 20022 we don’t know what kind of data is required or the use cases, we need to work with the card schemes, and we need to understand the needs of the user community. We need to find out what the superset of data actually is,” said one.

The consensus was that this would be best achieved by focusing on harmonisation of the payment messages. It is proposed to “take an inventory of what being done domestically and then look at the commonality of that”, as one participant phrased it.